Ugandans have been urged to embrace digital financial services as a safer and more convenient alternative to cash transactions.

The call came as Pearl Bank Uganda (formerly PostBank) and Stanbic Bank Uganda announced the integration of their digital wallets Wendi and FlexiPay — in a landmark partnership aimed at driving financial inclusion and cashless trade.

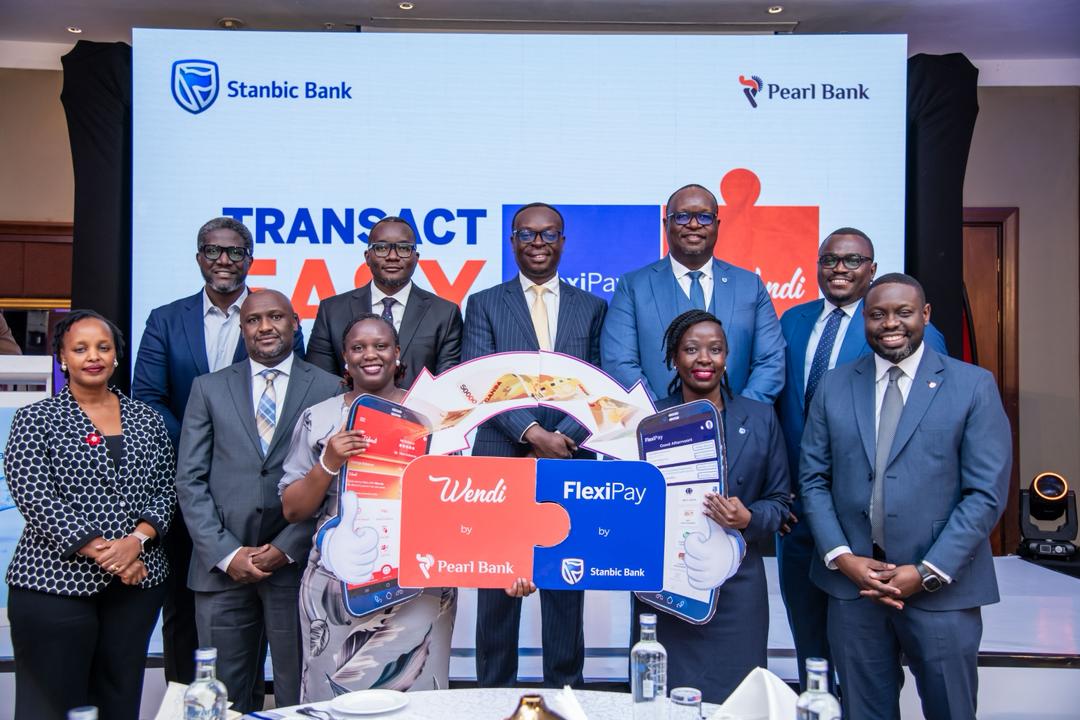

The announcement was made on Thursday during a joint press briefing at Sheraton Kampala, where the two institutions revealed that the integration will allow over one million combined users to transact seamlessly at significantly reduced fees.

The platforms support savings, credit and e-commerce payments.

Speaking at the launch, Julius Kakeeto, Managing Director and CEO of Pearl Bank Uganda, said digital systems provide transparency and accountability because “every transaction can be tracked,” helping users manage their money more securely.

He noted that the partnership will extend services to rural and peri-urban communities, especially farmers, youth and women entrepreneurs.

“By connecting FlexiPay and Wendi, we are breaking down digital walls to ensure that no matter where people live or who they bank with, they can transact safely and affordably,” Kakeeto added.

Stanbic Bank CEO Mumba Kenneth Kalifungwa described the partnership as “a win for ordinary Ugandans” and aligned it to Stanbic’s agenda of supporting women, youth and farmers through financial inclusion.

FlexiPay currently has over 17,800 agents, while Wendi has more than 8,000 agents and has played a key role in government programmes such as the Parish Development Model.

The move comes as Uganda pushes forward with the National Financial Inclusion Strategy (2023–2028), which shows access to formal financial services has improved from 52% in 2013 to 68% in 2023, progress largely driven by digital innovations. Despite this growth, many rural Ugandans remain excluded.

Rollout of the integration will be phased, beginning with joint awareness campaigns and shared merchant and agent support.

Both banks say the collaboration will make digital transactions faster, cheaper and more accessible, while reducing reliance on cash-based trade.

By Charles Katabalwa

24th Oct 2025

End